Article provided by Jenn Price-Locke

2022 has certainly been a whirlwind of a year in the Housing and Mortgage space…. the same is true for every other sector of our economic lives as consumers, employees and employers.

Many current, new and aspirational homeowners are dumbfounded. And there is good reason for that.

Back in July 2020, when interest rates were at emergency-induced rock-bottom levels, the message provided by Tiff Macklaim, Governor of the Bank of Canada (and other Central Banks around the Globe), was that “If you’ve got a mortgage, or if you’re considering making a major purchase… you can be confident rates will be low for a long time”.

It was widely expected that it would be the end of 2023 – early 2024 before rates increases would begin by the Central Bank and even more importantly, that when it started to happen, it would be done gradually.

Even into Spring of 2022, when the first increase of 0.25% happened on March 2nd, we anticipated they would give it time to let that take effect. Here we are in December and we have experienced a record seven consecutive rate hikes, bringing the overnight rate up a whopping 4% from where we sat at the start of the year.

Finally, there is hope that the BoC will pivot into 2023 and stop the hikes, allowing time for the effects to cycle through the economy.

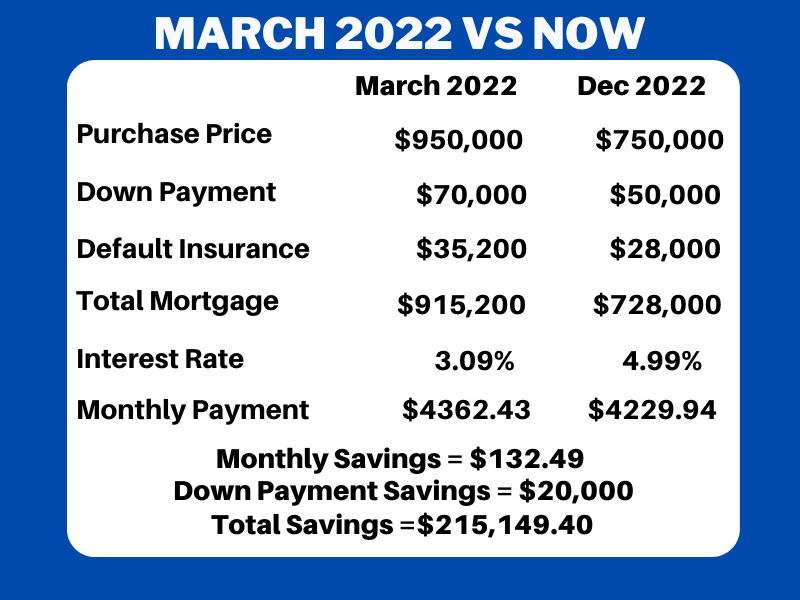

As this happens, the 5-year fixed mortgage rates are starting to soften. We now see the 5-year fixed insured rate down from 5.44% in November to 4.99% in early December.

The increase in interest rates has put a decline on demand for homebuyers, which in-turn has lowered purchase prices. See the chart below for a comparison of where we sit today, vs the end of March just after the Bank of Canada hikes began.

There’s always a silver lining. Rate is just part of the discussion.

\

\

Now, into Spring of 2023 is a great time for home buyers.

If you are thinking of a purchase, then obtaining a pre-approval and a rate hold for 120 days is a wise move. If rates are lower by the time you purchase, you’ll get the lower. If not, you’ll be protected. The same is true if your mortgage is maturing within the next 120 days, or if you are thinking of debt consolidation/refinancing.

Of course, if you want to make a move, or invest in Real Estate, there’s never a bad time to become a homeowner as long as you can hold onto your property for the long run.

I’ve always love this quote: “Don’t wait to Buy Real Estate. Buy Real Estate and Wait.”

To take a look at your situation and options, reach out any time. I’m local, passionate about remaining educated and always happy to help. My services are always free for prime mortgages.

As 2022 comes to a close, I would like to thank my clients and referral partners for your ongoing support and trust this year. It is always pleasure serving every single one of you and I truly care and have your best interests at heart.

Have a safe, healthy and happy Holiday Season!