What do you want from retirement?

After years of working hard and saving for your future, you may be getting ready to enjoy the retirement lifestyle you’ve envisioned. Or perhaps you’re already retired and exploring exciting new opportunities now that you have more time to devote to yourself and your loved ones.

Even if you’re well prepared financially, you may feel uneasy about the possibility of a market downturn eroding your portfolio’s value or rising inflation increasing the cost of essential items. And while you’re looking forward to a long and active life, you may be worried that you will outlive your savings.

Fortunately, there’s a simple solution that can help ensure your money lasts as long as you want it to — a payout annuity.

Payout annuities are an effective, easy-to-manage solution that provides you — or you and your spouse, if you choose — with a guaranteed level of income for the rest of your life or for a specified number of years. They can help cover your fixed expenses during your retirement years. That’s why they are considered a foundational product for a well-balanced retirement portfolio.

RBC Payout Annuities

In exchange for a single lump-sum deposit, RBC® Payout Annuities provide you with guaranteed income for life, or for a specific term, so you can have the peace of mind and the security you need to enjoy your retirement to the fullest.

Choosing the right type of annuity

Your needs are as personal as your dreams for retirement. That’s why we offer you three types of payout annuities. Here is a brief summary of the key advantages of each and how they can help you achieve the kind of retirement you want.

A single life annuity is based on the life of one person. It provides a guaranteed income stream for as long as you live and will not fluctuate regardless of market conditions or interest rate changes.

A joint life annuity is based on the lives of two people, usually a married couple. When one spouse passes away, payments will continue for the life of the surviving spouse.

A term certain annuity provides guaranteed payments for a predetermined number of years or until you reach a certain age. The periodic payment to you may be higher than single or joint life annuity payments because the monthly payments may not need to last as long.

Customize with optional features

Payout annuities usually offer a variety of flexible options to choose from, so you can customize your annuity to meet your specific objectives.

For example:

1. Minimum payment guarantee period

“What if I pass away only a couple of years into my life annuity? I’ll miss out on years of payments.”

The minimum payment guarantee protects against this possibility. If you (or you and your spouse) pass away before the end of the guarantee period, the

remaining payments will continue to be paid to your named beneficiary, or paid out as a lump sum — it’s your choice. With RBC Payout Annuities, you can

choose a minimum guarantee period of 1 to 25 years.

2. Return of premium guarantee

“What if I buy an annuity and then pass away the next day? Will my estate be left nothing?”

The return of premium guarantee protects against this scenario. Your entire premium will be refunded to your named beneficiary if you pass away before receiving your first annuity payment. All RBC Payout Annuities include this guarantee.

Benefits at a glance

Why should you consider a payout annuity as part of your retirement portfolio? Here are six good reasons.

- Guaranteed income for life.

When you purchase a life annuity, you don’t have to worry about outliving your money. Your payments can be guaranteed for as long as you are alive

- Income security.

Your payments are locked in from the moment of purchase. There’s no chance that market fluctuations will erode the value of your capital, or interest rate fluctuations will affect the level of income you receive.

- Tax benefits.

When you use non-registered funds (subject to legislative requirements) to purchase an annuity, the interest portion of your payment is spread out evenly over the life of your annuity (this is called a “prescribed annuity”). Prescribed annuities level out tax payments, thereby minimizing the amount of tax paid.

- Ease of management.

There are no ongoing investment decisions to make. Once you’ve purchased your annuity, you’re set.

- Estate planning benefits.

Payments can be guaranteed to continue to your surviving spouse or other beneficiary for a minimum number of years in the event of your death. In addition, the amount goes directly to your beneficiary and does not have to go through probate.

- A flexible, strategic income option.

You can use your retirement savings to buy an annuity at any time — just before retirement, at retirement or at any time during retirement. And you can convert some or all of your savings, depending on the extent of your guaranteed income needs. For example, if you need guaranteed income to cover just a certain number of fixed expenses, you can buy an annuity that produces the income level you need to cover these costs alone.

Choosing the solution that’s right for you

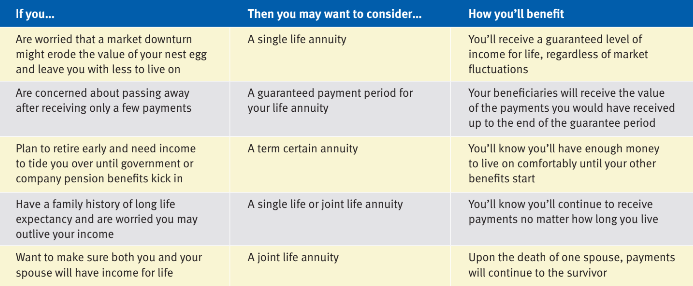

A payout annuity has the flexibility to be useful in a variety of situations. For anyone who is retired or close to retirement but still not sure if a payout annuity is the right choice for them, the table below provides a few examples, to act as thought-starters.

For more examples of how payout annuities can help your retirement, talk to your insurance advisor.

Why choose RBC?

RBC Insurance® offers a range of registered and non-registered payout annuities with flexible features that can be tailored to

meet your needs for income and security.

All RBC Payout Annuities are backed by the strength and stability of RBC — one of the country’s largest financial institutions.

For more information, please contact Francisco Fonseca, CFP®, CIM, FCSI, CSWP today! Francisco is a certified financial planner and can be reached at (416) 565 0017 or [email protected].

This guide is not a contract. It has been developed to help you understand the options available to you under a Payout Annuity Contract. While

every effort has been made to ensure the accuracy of the information in this guide at the date of printing, some errors and omissions may occur.

In the event of discrepancy, the terms of your policy will prevail.

Underwritten by RBC Life Insurance Company.

® / ™ Trademark(s) of Royal Bank of Canada. Used under licence. VPS85735

Insurance Services provided by FL Fonseca Financial Solutions Inc.