Your estate is the sum of your lifetime of hard work, smart investing and sensible financial planning. It is your greatest legacy to your loved ones. Estate planning allows you to protect the wealth you’ve accumulated over your lifetime while helping you to better manage your family’s financial future.

No matter how young or old you are, how much wealth you have, whether you’re married with children or are single, everyone can benefit from developing an estate plan. It not only gives you the peace of mind of knowing your wishes are in place, it can also reduce the taxes and expenses of your estate, as well as make the transition of your assets to your named beneficiaries a quicker and smoother process.

Who can help you plan your estate?

While this article is a general reference guide that can help you get started on the estate planning process, it’s important to prepare your personal estate plan with the help of professionals such as a will and estate planner, an estate lawyer¹ and an accountant.

It’s also important to talk to your advisor about specific issues relevant to your situation.

What are the benefits of estate planning?

Planning your estate helps minimize many of the concerns that may arise when you pass on. Without a plan, your legacy may be unduly affected by estate fees, or it may take years to pass your estate on to your beneficiaries.

It’s also important to communicate your wishes to your family and named beneficiaries to avoid confusion, hurt feelings and family discord.

By planning your estate, you are helping to:

- Protect your capital from taxation so more of your wealth can go to your named beneficiaries

- Pass your wealth on to your named beneficiaries according to your wishes

- Minimize family conflict by letting your loved ones know of your wishes

- Enable certain assets, such as segregated funds, to bypass probate (the process by which a court formally approves a will as the valid and last testament of the deceased person)

- Minimize taxes and fees by structuring your wealth in a tax-efficient manner

- Structure a portfolio of assets that may help protect the confidentiality of your named beneficiaries and keep your estate a private family matter

- Avoid the delays that occur when your assets are tied up in the court system

- Structure your wealth to avoid “affluenza,” which occurs when adult children do not have the experience to manage sudden wealth

What you should consider when planning your family’s estate

There are many steps involved in the estate planning process. Here are some guidelines that will help you understand which information you need to get started.

- Gather the following documents and information and keep them in a centralized file:

- Birth certificates

- Marriage certificates

- Social insurance numbers

- Real estate deeds

- Wills and powers of attorney

- Safety deposit box information

- Contact information for your:

- Executors² and named beneficiaries

- Advisors, lawyers and accountants

The RBC Insurance® Family Inventory Guide can help you capture and organize this important information. You can obtain a copy of this guide from your advisor.

- Prepare or re-evaluate your wills:

- Prepare, review or update your will(s) to ensure it reflects your wishes

- Prepare, review or update your powers of attorney

- Designate someone to take over your personal affairs should you become unable to manage your estate

- Designate an executor(s) or a corporate executor to administer your will after you pass on

- Give careful consideration when appointing a spouse, child, sibling or other family member as executor of your will

- What should you consider when choosing an executor(s)?

- As an executor, you are responsible for settling an estate according to the deceased’s wishes

- Legal, tax and administrative issues can make the duties of an executor complex and time-consuming

- Many people find these responsibilities especially burdensome while they are grieving the loss of a loved one — careful consideration should be given in appointing a spouse, child, sibling or other family member

Use the RBC Insurance Executor Checklist to understand the responsibilities of the executor(s) of your estate, and then designate them accordingly. You can obtain a copy of this checklist from your advisor.

- Make an inventory of your family’s assets and liabilities:

- List all of your assets and liabilities

- Review the ownership structure of your assets:

- Single or various joint ownerships with joint tenants with and without the right of survivorship

- Name your beneficiaries either as revocable or irrevocable:

- Revocable means the owner can change the named beneficiary at any time

- Irrevocable means you need the consent of the named beneficiaries to make the change

- Assess your financial preparations:

- Review your pension(s) and investments to ensure they meet your financial goals

- Review and evaluate your insurance coverage to ensure the amount and type of insurance are adequate to cover final expenses and all of your family’s ongoing needs

- Arrange a prepaid funeral to spare your family the burden of having to deal with the details of a funeral in their time of distress; it also relieves them of the financial stress associated with funeral costs

RBC Guaranteed Investment Funds: A smart investment for your estate

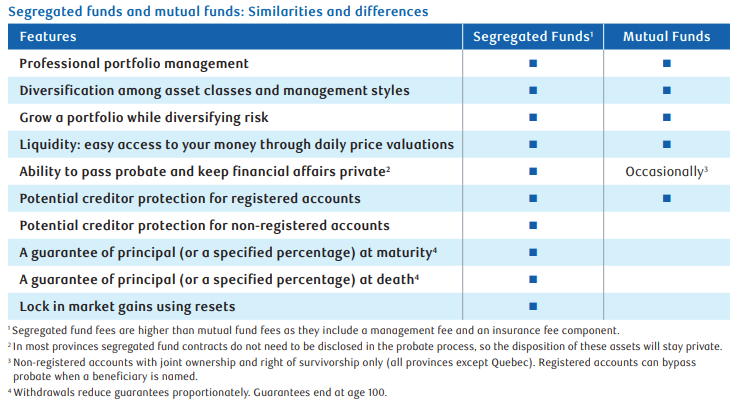

As mentioned previously, there are many strategies and tools that can help you in planning your estate. Take, for example, segregated funds. Segregated funds, like RBC® Guaranteed Investment Funds (GIFs), offer you growth potential with the security of a principal guarantee. They are similar to mutual funds in many respects, but provide a number of additional features and benefits.

Here is a quick summary of the added features that can make segregated funds an excellent alternative to mutual funds.

RBC GIFs benefit your estate planning in many ways

- Bypass probate: As a special investment vehicle, segregated fund assets bypass probate (unless the estate is named as the beneficiary), they remain private³, and their proceeds are paid directly to your named beneficiaries (not applicable in Quebec).

- Preserve capital and upside growth potential: Segregated funds provide risk protection against declining markets through maturity and death benefit guarantees. They also provide the ability to lock in investment gains using reset features.

- Minimize fees: Investing in segregated funds allows you to minimize probate, executor, legal and accounting fees due to the ability to bypass probate for assets held in these contracts.

- Provide possible creditor protection: Segregated funds with appropriate beneficiary designations offer possible creditor protection, which is beneficial for business owners or self-employed professionals whose assets may be exposed to creditors.

When you choose to invest in segregated funds such as RBC GIFs, the underlying funds are backed by the integrity and expertise of RBC Insurance and RBC Global Asset Management Inc. (RBC GAM), one of Canada’s leading money managers.

You can benefit from RBC GAM’s proven track record of delivering strong long-term performance and worldclass investment management.

The following case study illustrates how RBC GIFs are a smart investment choice when it comes to estate planning.

The Johnson Family — How they protected their investments

Steve, 66, and Sara, 64, have three children. Steve is semiretired and does consulting work on a part-time basis. Sara is still working, but plans to retire in two years’ time. Steve and Sara have a sizeable retirement portfolio, consisting of stocks, bonds and mutual funds, which is adequate to provide retirement income for the rest of their lives.

They intend to leave at least $500,000 of their assets to their children as an inheritance, but they do not have a formal estate plan. They’d like the opportunity for these assets to profit more from market growth, but would also like to minimize their risk and preserve the capital for their children’s inheritance. Last year, a close friend and his wife passed away.

Through their will, they left $250,000 in mutual fund investments to their children. Months later, the children are still waiting to receive their inheritance because all of their parents’ assets are caught up in the probate process.

The right advice from their advisor

Steve and Sara would like to avoid a lengthy, costly and public process for their children’s inheritance. They also want to be sure their children have access to the funds quickly after their death. They sat down with their advisor, who proposed that they update their wills and restructure their investment portfolio in order to protect and expedite funds going to their heirs.

He suggested that they move the $500,000 intended for their children into an RBC GIF contract. This solution would provide them with the protection and growth potential they are looking for while allowing the funds to be accessible should the need arise.

Incorporating segregated funds in their estate plan can benefit Steve and Sara in at least four ways

- Capital preservation — The death benefit guarantee will preserve their capital for their named beneficiaries (their three children). This unique feature of segregated funds means that regardless of market fluctuations, 100% of their initial capital in the RBC GIF contract is guaranteed to be paid to their children.⁴

- Mutual funds and traditional stock and bond portfolios do not have this feature.

- Prompt access — Since an RBC GIF contract is an insurance policy with named beneficiaries, the death benefit proceeds can bypass probate (unless the estate is named as the beneficiary) and the death benefit can be paid quickly and directly to their children.

- Privacy⁵ — Another benefit of bypassing probate is that Steve and Sara will keep their children’s inheritance private and their names will not be revealed.

- Savings — As segregated funds enable you to bypass probate (unless the estate is named as the beneficiary), executor, legal and accounting fees can also be minimized. Steve and Sara’s estate could potentially save a minimum of $6,750 just in probate fees.⁶ Executor, legal and accounting fees are dependent on the size and complexity of the estate.

Any amount that is allocated to a segregated fund is invested at the risk of the contractholder and may increase or decrease in value.

RBC Guaranteed Investment Funds are individual variable annuity contracts and are referred to as segregated funds. RBC Life Insurance Company is the sole issuer and guarantor of the guarantee provisions contained in these contracts. The underlying mutual funds and portfolios available in these contracts are managed by RBC Global Asset Management Inc.

When clients deposit money in an RBC Guaranteed Investment Funds contract, they are not buying units of the RBC Global Asset Management Inc. mutual fund or portfolio and therefore do not possess any of the rights and privileges of the unitholders of such funds. Details of the applicable Contract are contained in the RBC GIF Information Folder and Contract at rbcinsurance.com/segregated-funds.

To learn more about how an RBC GIF can be an effective estate planning solution to protect your financial future and those of your loved ones, please contact Francisco Fonseca, CFP®, CIM, FCSI, CSWP today!

Francisco is a certified financial planner and can be reached at (416) 565 0017 or [email protected].

1 Notary in the province of Quebec.

2 Estate Trustee in Ontario. Liquidator in Quebec.

3 In most provinces segregated fund contracts do not need to be disclosed in the probate process, so the disposition of these assets will stay private

4 If the person invests in an RBC GIF before the age of 80. Reduced proportionally by any withdrawals.

5 In most provinces segregated fund contracts do not need to be disclosed in the probate process, so the disposition of these assets will stay private.

6 For illustrative purposes only. Assuming a $500,000 segregated fund portfolio for the province of Ontario. Ontario fees are calculated as follows: $15 per $1,000 of assets over $50,000. Probate fees vary by province. Source for Ontario probate is the Estate Administration Tax Act, 1998 S.O. 1998, Chapter 34.